nebraska sales tax percentage

An office or place of business. 1 You buy a item on Ebay for 1000 dollars and pay 75 percent in tax.

Taxes And Spending In Nebraska

Firstly divide the tax rate by 100.

. 75100 0075 tax rate as a decimal. What is the tax on it and what is the total price including tax. To easily divide by 100 just.

Much like sales tax in the rest of the country TPT is collected by merchants and remitted back to the state based on a percentage of a sale. Learn how to calculate sales tax by following these examples. For tax year 2021 married filing jointly taxpayers with federal AGI of 59960 or less and taxpayers filing any other return with federal AGI of 44460 or less may continue to.

Employees agents salespeople contractors etc. How to calculate sales tax. Taxpayers can claim either the percentage reduction enacted by LB 64 or the previously existing exemption for low-income recipients whichever is greater.

Once the MSRP of the vehicle is established a Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed. For tax year 2021 the percentage reduction is 5. The distribution of funds collected for the Motor Vehicle Tax are.

The percentage of the Base Tax applied is reduced as the vehicle ages. Present in the state. Ownership of or goods.

Nebraska considers a seller to have sales tax nexus if you have any of the following in the state.

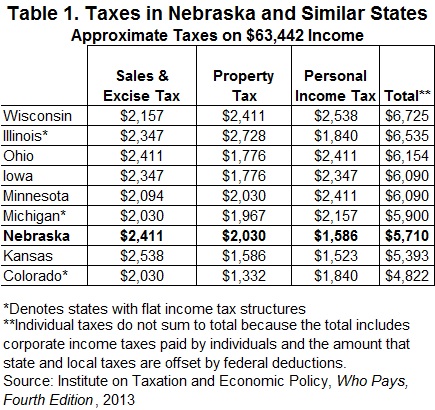

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Nebraska Sales Tax Small Business Guide Truic

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare