child tax credit payment schedule for september 2021

By making the Child Tax Credit fully refundable low- income households will be. Up to 300 dollars or 250 dollars depending on.

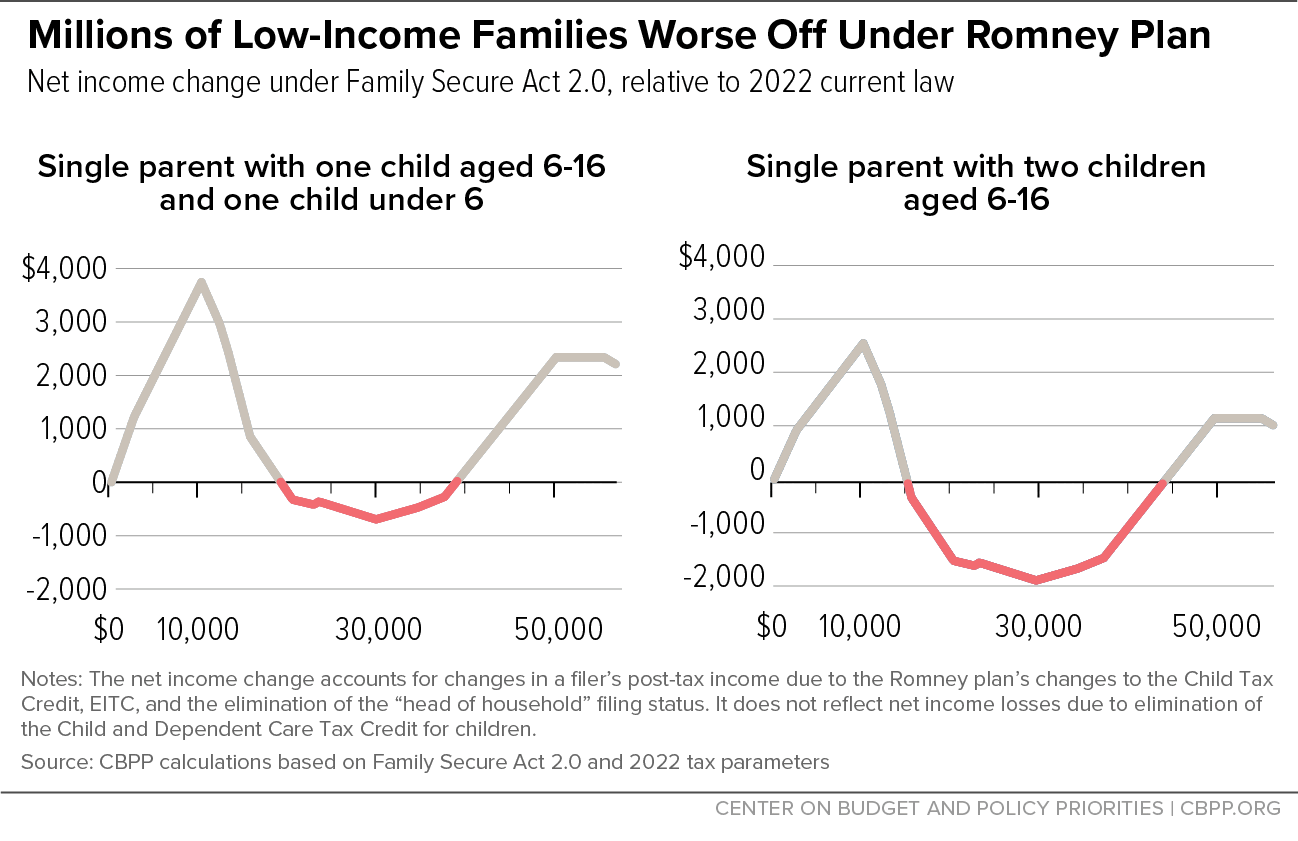

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Letters will also be going out to those who used the Non-Filers tool on irsgov last year to register for a stimulus payment as the tax credit is.

. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. For 2021 the credit amount is. The payments will be paid via direct deposit or check.

Recipients can claim up to 1800 per child under six this year split into the six payments. 3000 for qualifying children between age 6 to 17 years old. Determine if you are eligible and how to get paid.

CBS Detroit The third round of Child Tax Credit payments from the Internal Revenue Service IRS goes out this week. No monthly fee weligible direct deposit. Other amounts and phaseout income thresholds.

More information on the Child Tax Credit payments can be found. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers. Eligible families began to receive payments on July 15.

Ridofranz Getty ImagesiStockphoto. The schedule of payments moving forward is as follows. Of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. The credit was made fully refundable. Open a GO2bank Account Now.

October 5 2022 Havent received your payment. September 15 2021 809 AM. To reconcile advance payments on your 2021 return.

The advance is 50 of your child tax credit with the rest claimed on next years return. Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment. What is the schedule for 2021.

All payment dates. The rebate caps at 750 for. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The remaining 2021 child tax credit payments will be released on Friday October 15 Monday November 15 and Wednesday December 15. The increased amounts are reduced phased out for modified adjusted gross income. 3600 for qualifying children age 5 and under.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. The complete 2021 child tax credit payments schedule. Enter your information on Schedule 8812 Form.

Six payments of the Child Tax Credit were and are due this year. Child Tax Credit Payment Schedule For 2021 Heres When Youll Get Your Money. Get your advance payments total and number of qualifying children in your online account.

Up to 7 cash back with Gift cards bought in-app. September 14 2021 at 135 pm. Child tax credit Norm Elrod.

The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36 million families believed to be eligible to receive them. Set up Direct Deposit. Ad Get Your Bank Account Number Instantly.

The credit amount was increased for 2021. 2021 child tax credit The IRS is sending families the September installment of the 2021 Child Tax Credit on the 15th but how long will it. Each payment will be up to 300 for each qualifying child under the age of 6 and up to 250 for each qualifying child from ages 6-17.

Wait 10 working days from the payment date to contact us. Up to 300 dollars or 250 dollars depending on age of child August 15 PAID. Ad The new advance Child Tax Credit is based on your previously filed tax return.

So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per. Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18.

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Can Both Parents Claim Their Child On Taxes

Work Opportunity Tax Credit Department Of Labor Employment

Child Tax Credit U S Senator Michael Bennet

2021 Child Tax Credit Advance Payments Claim Advctc

About The Ctc How Much Is The 2021 Child Tax Credit

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Tax Season What You Need To Know To Claim The Child Tax Credit

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

![]()

2021 Child Tax Credit Advanced Payment Option Tas

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Tax Season What You Need To Know To Claim The Child Tax Credit

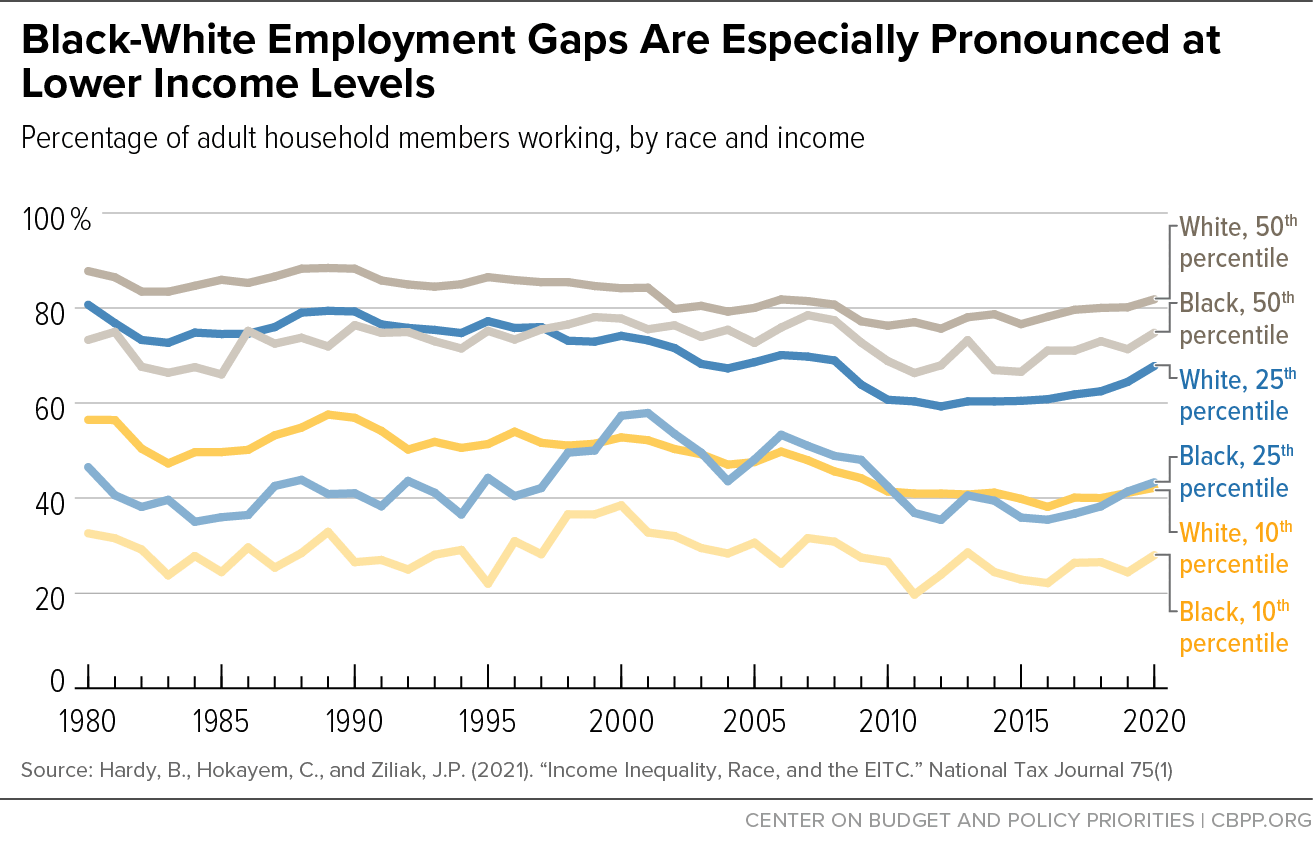

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times